The Nashik CGST and Central Excise Commissionerate, established in 2002, is one of four Executive Commissionerates within the Nagpur Zone. It holds jurisdiction over the northern districts of Maharashtra, ensuring the fair, equitable, and efficient collection of government revenue under the Goods and Services Tax (GST). The Commissionerate is dedicated to combating tax evasion, commercial fraud, and related illicit activities. The Nashik Commissionerate comprises of five (05) northern districts of Maharashtra, Viz. Nashik, Dhule, Jalgaon, Nandurbar and Ahmednagar. The total area of this commissionerate is 57,440 Sq. Kms having 54 talukas.

The present Nashik Commissionerate started off as a Division situated at Baccha Manor House, N D Patel Road, Nashik having jurisdiction over the entire Nashik District and was part of the erstwhile Pune Commissionerate since 1950. In 1983, due to industrialization, a separate Commissionerate at Aurangabad was formed and Nashik Division came under its jurisdiction. Nashik was further allocated another Division in June, 1989 and then a third Division was formed in the year 1999. A fourth Division was further setup in the year 2002. On 1st November, 2002 due to the tremendous growth in the Revenue from Petroleum and Automobile sectors, Nashik finally got its due in the form of a Commissionerate.

The Jurisdiction of Nashik Commissionerate then covered the districts of Nashik, Jalgaon, Dhule, Nandurbar and part of Ahmednagar District namely Sangamner Taluka. During the reorganization in the year 2014, the setup was further expanded by forming two Commissionerates Nashik - I and Nashik II and attaching the entire district of Ahmednagar. All the while the jurisdiction of Nashik Commissionerates covered the enforcement of Central Excise Act, 1944, Finance Act, 1994, Customs Act 1962 and various other Allied Acts.

After the passage of the 122nd Constitutional Amendment Act and the Central Goods and Services Act, 2017 read with Trade Notice No. 03/2017 dated 22.06.2017, the Nashik-I and Nashik-II Commissionerate was restructured into GST and Central Excise Commissionerate Nashik

The Commissionerate assesses and collects Central Goods and Services Tax (CGST) and Central Excise duty from businesses within its jurisdiction.

It enforces tax laws through assessments, investigations, and other actions, preventing tax evasion, curbing and ensuring compliance.

The Commissionerate offers guidance and support to taxpayers on GST and Central Excise matters, including registration, returns, and refunds.

It addresses taxpayer grievances and resolves disputes related to tax assessments and other issues.

Our vision is to establish an efficient and transparent mechanism for indirect tax collection, fostering voluntary compliance. Our mission is to achieve excellence in the formulation and implementation of GST laws and procedures, aiming to: Realize government revenues fairly, equitably, transparently, and efficiently; Administer economic, taxation, and trade policies pragmatically; Facilitate trade and industry by streamlining GST processes and enhancing Indian businesses' competitiveness; Create a climate of voluntary compliance through information and guidance; Combat revenue evasion, commercial fraud, and social harm; Contribute to national security efforts.

We are committed to upholding the highest standards of integrity, impartiality, courtesy, objectivity, transparency, and efficiency. We serve the country and its citizens, working to ensure economic security and sovereignty. Our procedures and transactions are as transparent as possible, and we actively encourage and assist voluntary tax compliance.

The Nashik CGST and Central Excise Commissionerate exercises jurisdiction over the following districts within the state of Maharashtra: Nashik, Dhule, Jalgaon, Nandurbar, and Ahmednagar. In order to streamline tax administration and adapt to the dynamic landscape of indirect tax compliance within the Nagpur Zone, the Nashik Commissionerate's jurisdiction has been meticulously divided into five divisions: Nashik-I, Nashik-II,Dhule, Jalgaon, and Ahmednagar. The following accompanying map is for an illustrative overview of the commissionerate's jurisdictional boundaries. (Note: This map is for illustrative purposes only and is not drawn to scale.)

The Nashik CGST and Central Excise Commissionerate exercises jurisdiction over the following districts within the state of Maharashtra: Nashik, Dhule, Jalgaon, Nandurbar, and Ahmednagar. In order to streamline tax administration and adapt to the dynamic landscape of indirect tax compliance within the Nagpur Zone, the Nashik Commissionerate's jurisdiction has been meticulously divided into five divisions: Nashik-I, Nashik-II,Dhule, Jalgaon, and Ahmednagar. The following accompanying map is for an illustrative overview of the commissionerate's jurisdictional boundaries. (Note: This map is for illustrative purposes only and is not drawn to scale.)

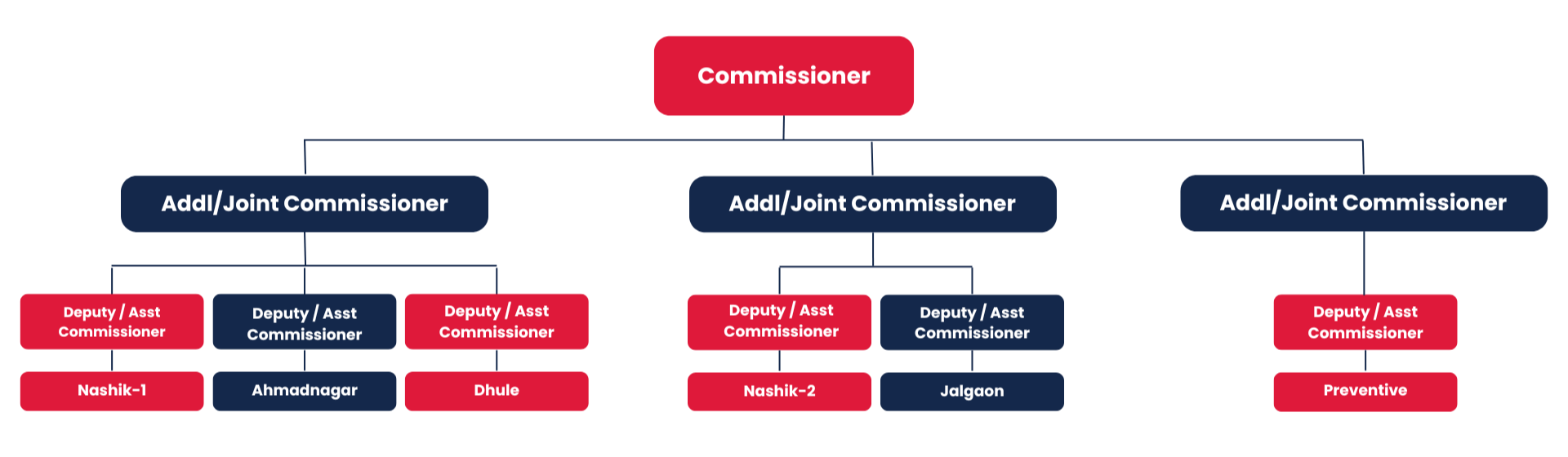

Nashik Commissionerate is headed by the Commissioner, who is the Administrative and Executive head of the Commissionerate. The Commissioner is assisted by Additional Commissioners/Joint Commissioners, Deputy Commissioners/Assistant Commissioner, Superintendents, Administrative Officers, Inspectors, Tax Assistants, UDCs, LDCs, Head Hawaldars, Hawaldars, Sepoys etc in the order of hierarchy.

It operates through a network of Divisional Offices and Range Offices located in different parts of its jurisdiction. The Divisions are further subdivided into Ranges. Each Division is headed by a Deputy / Assistant Commissioner and Range is headed by a Superintendent. The Divisional Deputy/Assistant Commissioner is assisted by Superintendents, Administrative Officers, Inspectors, Executive Assistants, Tax Assistants,LDCs, Head Hawaldars, Hawaldars, Sepoys etc in the order of hierarchy.